The reform bill includes amendments to taxes levied on individuals.

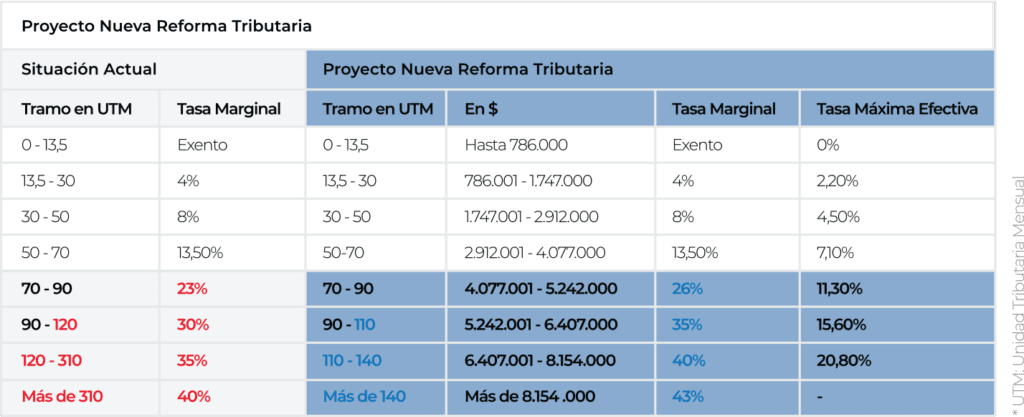

1. Employee’s Income Tax brackets and rates are amended

2. Personal Income Tax brackets and rates are amended

The onerous differential treatment that applied to income received by higher ranking public authorities (President of the Republic, Ministers of State, senators and deputies) was eliminated.

3. Deductions for rental expenses

The reform bill introduces a deduction for annual rental expenses within a fiscal year. This applies to residential housing rental that taxpayer uses.

The deduction will be the rent paid with an annual limit of approximately Ch$5,590,000 (8 UTA).

An individual taxpayer may claim the deduction for only one house in a calendar year. If a taxpayer has paid rental for more than one house in a calendar year, they may deduct all of them if they do not overlap within that calendar year.

If a taxpayer has overlapping rentals that meet the above requirements, they may deduct the highest value rental.

If a taxpayer meets the requirements to qualify for this deduction and for the mortgage loan interest deduction, they must choose only one of them.

4. Deductions for care expenses

The reform bill introduces a deduction from taxable income related to payments for the care of the following people:

- People under two years old, unless the taxpayer receives the benefit of nursery care under Article 203 of the Labor Code.

- People with an accredited severe or profound dependency.

The deduction will be the expense with an annual limit of Ch$6,990,000 (10 UTA). This limit applies regardless of the number of people in the taxpayer’s care.

Only the taxpayer caring for the toddlers may deduct this expense. If more than one person cares for the children, then the deduction may be shared equally between them.

5. Limitation on mortgage interest deductions

The bill limits deductions from taxable income subject to Personal Income Tax of interest associated with a loan secured with a mortgage. If the taxpayer has more than one mortgage loan, only the interest on the loan with the most interest can be deducted.

6. General limitations

The bill establishes a general limit on taxable income deductions and exempts income or tax credits against final taxes.

Thus, the following limits are established:

- A general limit of Ch$16,076,000 (23 UTA) applies to deductions from taxable income.

- The deduction from income exempt from Personal Income Tax and credits against this tax will be limited to Ch$1,608,000 (2.3 UTA) or 50% of the Personal Income Tax before these deductions are applied.

The credit against Corporate Income Tax and the feature of exempt income of the new Capital Income Tax on profit distributions by large companies will not be subject to these limitations.

7. Effective date

The reform bill proposes that these amendments become effective as of 2023.